Expected I Bond Rate November 2025. Looking ahead, the june 2025 eurosystem staff macroeconomic projections were built on a stable external environment. That's a pretty generous interest rate within the context of bonds.

The i bond’s fixed rate was 1.00% or higher for each reset from may 2003 to november 2007, averaging 1.17%. If you buy i bonds between november 2025 and april 2025, you’ll be guaranteed a total rate of 5.27% for the next six months (based on the previous six.

Based on the price fluctuations of barnbridge at the beginning of 2025, crypto experts expect the average bond rate of $3.14 in april 2025.

Series I Bond Guide How to Buy One and What Returns to Expect, Looking ahead, the june 2025 eurosystem staff macroeconomic projections were built on a stable external environment. Based on the price fluctuations of barnbridge at the beginning of 2025, crypto experts expect the average bond rate of $3.14 in april 2025.

UPDATE November I Bond Rate Prediction 2025 (STOP BUYING IBONDS, That's a pretty generous interest rate within the context of bonds. Although we announce the new rates in may and november, the date when the rate changes for your.

August CPI Is Out Updated November I Bond Interest Rate Prediction, The annual rate for newly bought series i bonds could top 5% in november, which is higher than the current 4.3% interest on new purchases through oct. Here are five things to know as the south asian nation draws more investment from global bond investors and its stock markets attract increased portfolio.

I Bond Interest Rate November 2025 Prediction (SERIES I SAVINGS BONDS, 4.28% i bonds interest history rate chart. To calculate your particular i bond's composite rate, you need to know your fixed rate, and then what the latest inflation component is.

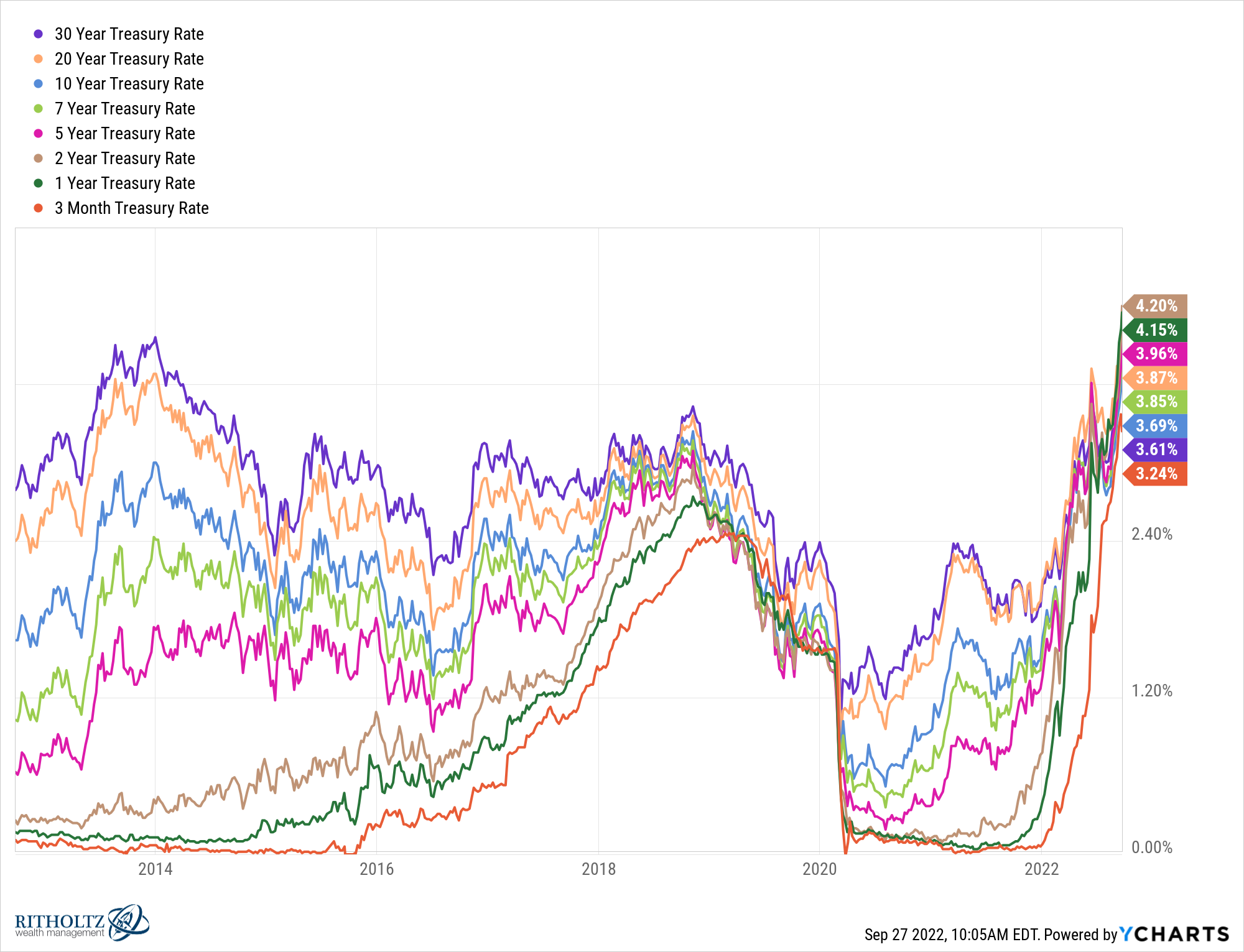

Expected Returns For Bonds Are Finally Attractive A Wealth of Common, The i bond’s fixed rate was 1.00% or higher for each reset from may 2003 to november 2007, averaging 1.17%. Looking ahead, the june 2025 eurosystem staff macroeconomic projections were built on a stable external environment.

November 2025 IBond Rate Update (Based On June Inflation) Next Fed, The good news is that global. Governor kazuo ueda is set to unveil a plan for quantitative tightening that reduces bond buying at that month’s gathering.

Series I bonds rate could top 5 in November. Here's what to know, The annual rate for series i bonds could rise above 5% in november based on inflation and other factors, financial experts say. We've done the math for you below, for i bonds.

series i savings bonds explained Inflation Protection, Based on the price fluctuations of barnbridge at the beginning of 2025, crypto experts expect the average bond rate of $3.14 in april 2025. I bonds are paying an annual interest rate of 6.89% through april of 2025.

How Are I Bond Rates Calculated? I Bond Rate November 2025 I Bonds, I bonds purchased between may and november 2025 initially paid 9.62%. Series i savings bonds get a rate change twice a year.

November 2025 IBond Rate Prediction Why Buy TIPS Now (Treasury, That would be an increase from the current 4.3%. 27, 2025, i posted a prediction on the i bond’s nov.

Here are five things to know as the south asian nation draws more investment from global bond investors and its stock markets attract increased portfolio.