Ira Limits 2025 Tax. If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000. The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Find out the annual limits for traditional and roth iras, the deduction rules, and the age and income requirements. Learn about the new rules and limits for roth and traditional iras and 401 (k)s that will take effect in 2025.

Ira Limits 2025 Tax Brackets Liva Sherry, The maximum total annual contribution for all your iras (traditional and roth) combined is:

Roth Ira Limits 2025 Based Sybyl Eustacia, For 2025, the limit is $7,000 ($8,000 if age 50 or older), or.

Ira Limits 2025 Catch Up Madge Rosella, The contribution limits, which have increased since she began using.

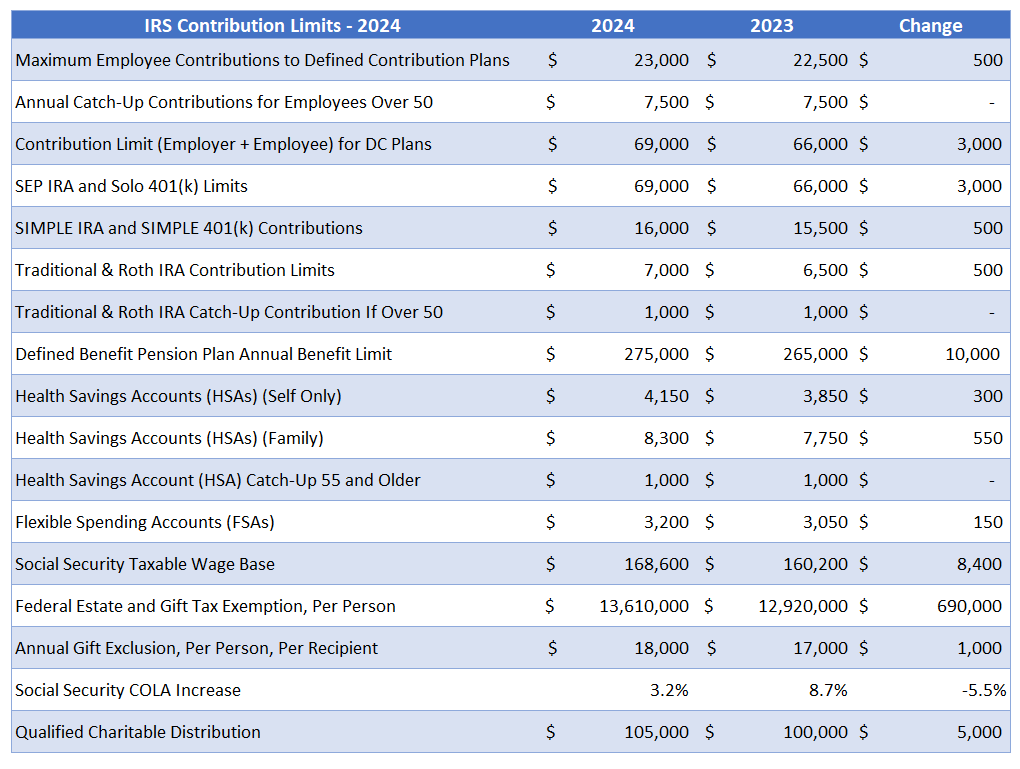

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, If you are 50 and older, you can contribute an additional $1,000 for a total of $8,000.

2025 Ira Contribution Limits Estimated Contribution Sabra Clerissa, The new inflation adjustments are for tax year 2025, for which taxpayers will file tax returns in early 2025.

Ira Limits 2025 In India Lacey Cynthea, There are traditional ira contribution limits to how much you can put in.

2025 Ira Contribution Limits Estimated Tax Form Ella Nikkie, The new inflation adjustments are for tax year 2025, for which taxpayers will file tax returns in early 2025.

Coverdell Ira Contribution Limits 2025 Inge Regine, The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

Roth Ira Limits 2025 Mfj 2025 Ibby Randee, The maximum total annual contribution for all your iras (traditional and roth) combined is:

IRA Contribution Limits in 2025 Meld Financial, There are traditional ira contribution limits to how much you can put in.